can i get a mortgage if i owe back taxes canada

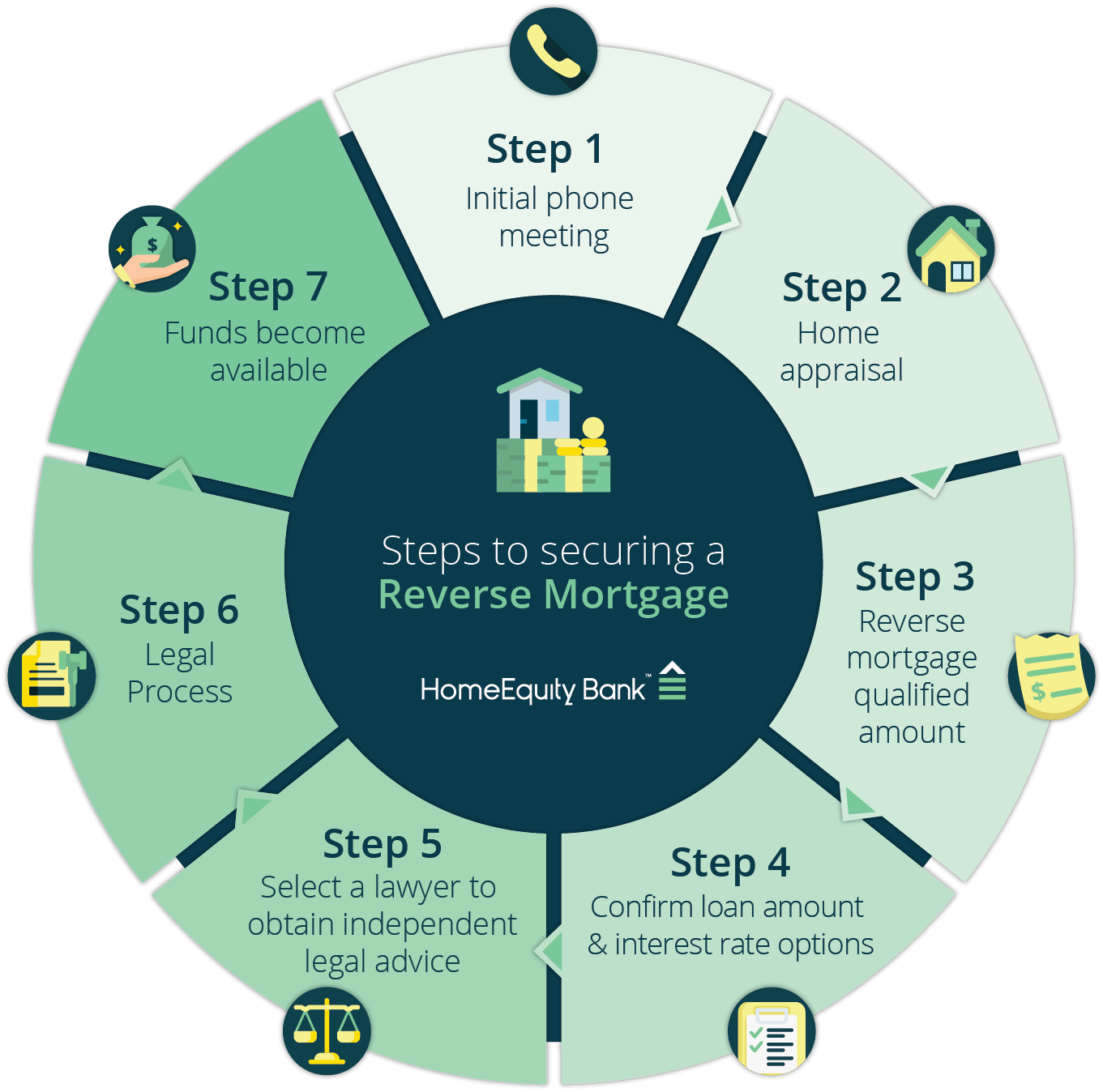

Can you get a reverse mortgage if you owe back property taxes. This includes having filed your taxes for the preceding two to three years.

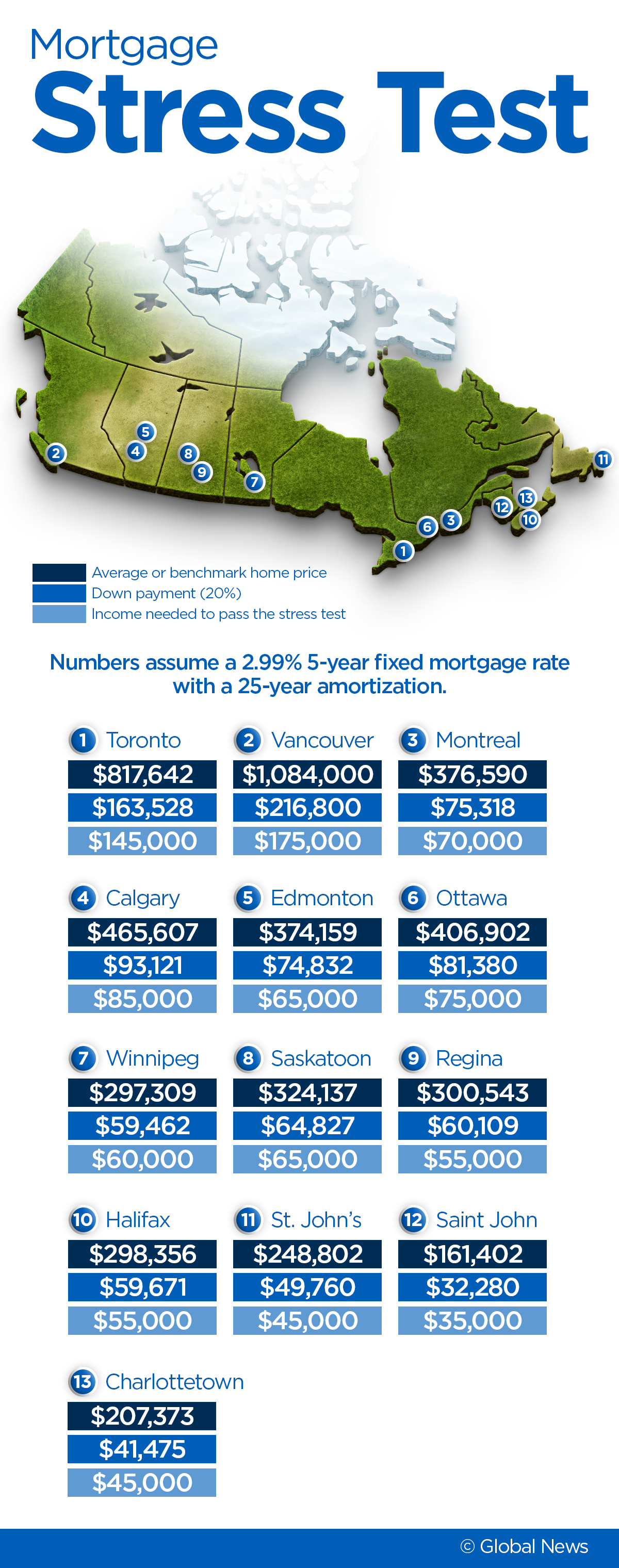

Here S The Income You Need To Pass The Mortgage Stress Test Across Canada National Globalnews Ca

Mortgage Relief Program is Giving 3708 Back to Homeowners.

. Can You Get A Mortgage If You Owe Taxes Canada. Not paying your taxes is a crime and has major financial and personal costs. Check Your Eligibility for Free.

Many people dont think its possible to get a mortgage if you owe the IRS back taxes. Back taxes no mortgage until now If you are paying back taxes with an installment plan most mortgage programs required you to clear your tax debt before getting a. In a nutshell it may be possible to get a home loan even if taxes are owedMortgage application procedures are significantly more complicated due to owing taxes or having tax liensIf you can work to resolve your tax debt even if it doesnt entirely go away your mortgage approval chances can improve.

Having tax debt also called back taxes does not preclude you from qualifying for a mortgage by sheer virtue of having it. Its not unusual to find you owe some money to the canada revenue agency cra after filing your personal tax returns. In short yes you can.

Mortgagees are required to determine whether the Borrowers have delinquent federal non-tax debt. Yes you might be able to get a home loan even if you owe taxes. Generally if you make a payment plan right away with them they wont file a lien against you.

Check Your Eligibility Today. New rules allow you to get a mortgage loan when you owe money to the IRS allowing you to purchase a wonderful house in a great area. If you are convicted of tax evasion it can also lead to court-imposed fines jail time and a criminal record.

Do you owe back taxes to the IRS or StateYouve found your dream home and just before you make it to closing you learn that the IRS has filed a tax. HOA dues the lender will require a Life Expectancy Set Aside per HUD guidelines to pay these expenses. During my real estate career I have been amazed by several buyers who did not understand the need to have their financial house in order before they apply for a mortgage.

1 If you owe the IRS back taxes you have to take the initiative and make a payment plan with the IRS right away. Also important for a self-employed borrower is that you can use your NOAs average of last 2 years to prove what income you earn for mortgage qualifying see Line 150 - Total Income. Property taxes can vary widely depending on where you live and what your homes value is.

The answer can depend on your particular situation. So if you dont file you receive notices with this estimated amount and the IRS can file a return on your behalf. All taxes must be brought current at the time of the loan and if you have been late on property taxes mortgage payments or any other property charges in the past 24 months ie.

Back taxes no mortgage until now If you are paying back taxes with an installment plan most mortgage programs required you to clear your tax debt before getting a mortgage. If you owe back property taxes the taxing authority gets a lien on your house for the amount due plus any interest and penalties. Tax debt caused by back taxes you owe are not easy to get away from.

Can you get a mortgage if you owe back taxes to the IRS. Homeowners Relief Program is Giving 3708 Back to HomeownerCheck Your Eligibility Today. Ad Use our tax forgiveness calculator to estimate potential relief available.

Mortgagees are prohibited from processing an application for an FHA-insured Mortgage for Borrowers with delinquent federal non-tax debt including deficiency Judgments and other debt associated with past FHA-insured Mortgages. If keeping your DTI low is most important to you then you may want to consider keeping the monthly payment on your repayment plan as low as possible. 50 of condo fees if.

We provide Immediate IRS Help to Stop Wage Garnishment and End Your Tax Problems. Why its better to address back taxes sooner rather than later. Can I Get a Mortgage If I Have Not Filed My Tax Returns.

In short yes you can. Im happy to tell you that it is possible and this is how you do it. Ad 2022 Homeowner Relief Program is Giving a One Time 3627 StimuIus Check.

Ad 2022 Federal Homeowner Relief Program is Giving a One Time 3627 StimuIus Check. A tax debt doesnt equal a blanket rejection for a mortgage application. So the short answer to the question can I get a mortgage if I owe taxes is unfortunately not likely.

The short answer is that owing the IRS money wont automatically prevent you from qualifying for a home loan. The IRP can also be used to assess the amount of taxes you should owe. Mortgage lenders are focusing on if you owe CRA money and will require you to prove your taxes have been paid before lending.

This will keep your monthly totals down which could keep you below. If convicted of tax evasion you must repay the full amount of taxes owing plus interest and any civil penalties assessed by the Canada Revenue Agency CRA.

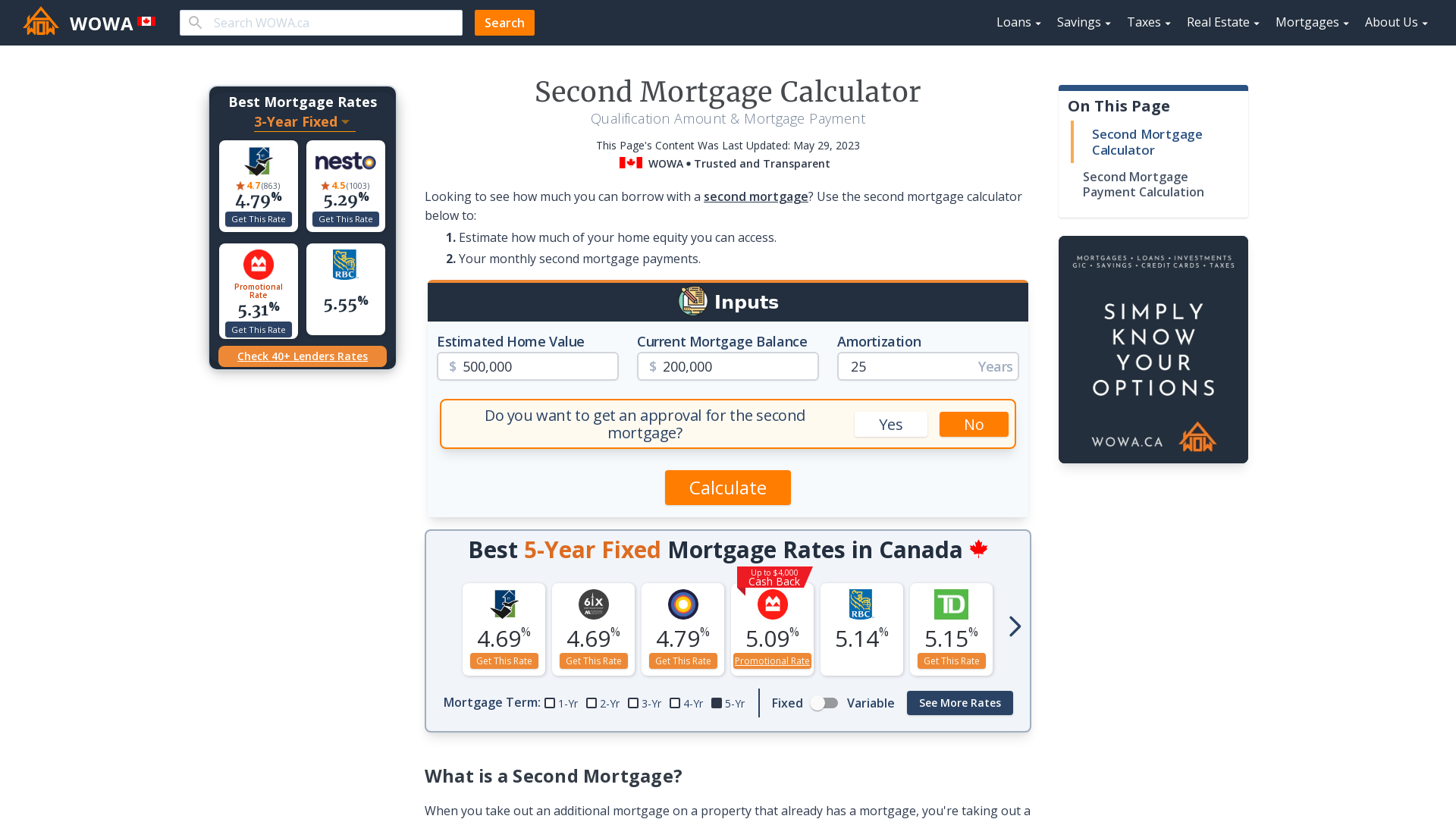

Second Mortgage Calculator Qualification Payment Wowa Ca

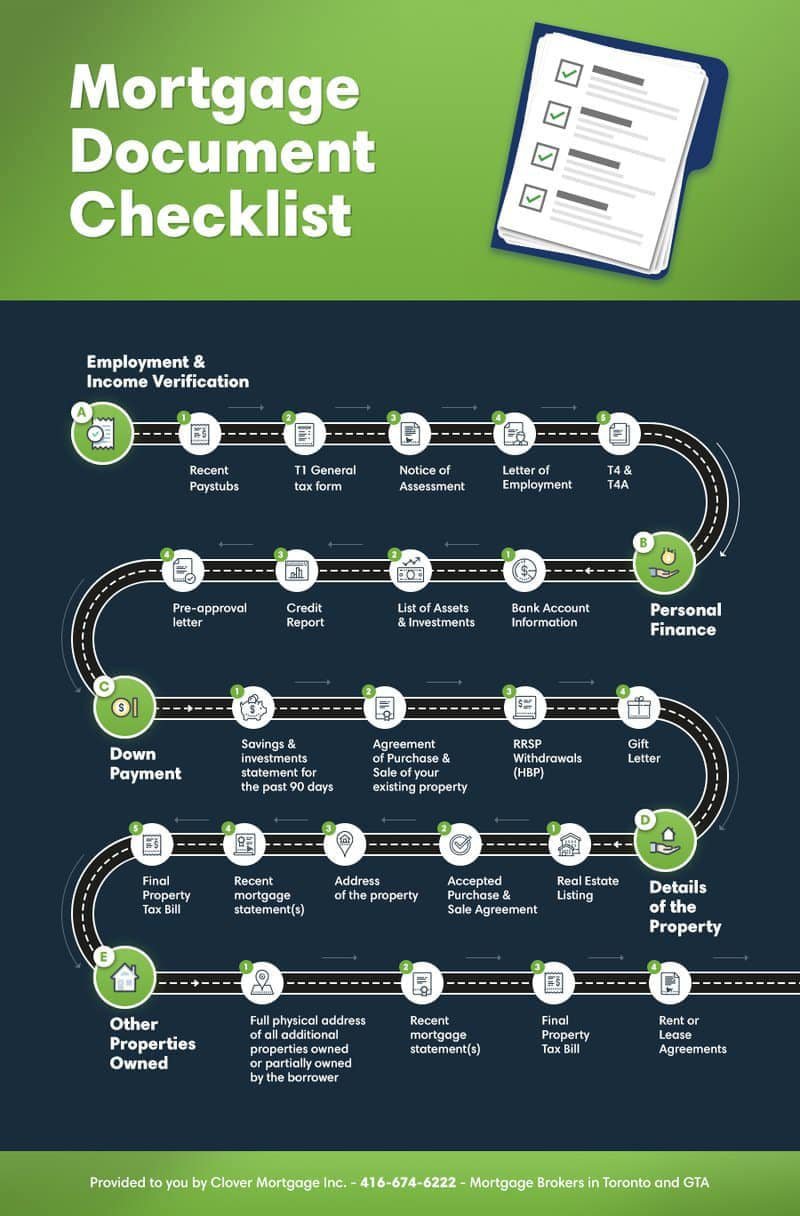

Mortgage Document Checklist What You Need Before Applying For A Mortgage

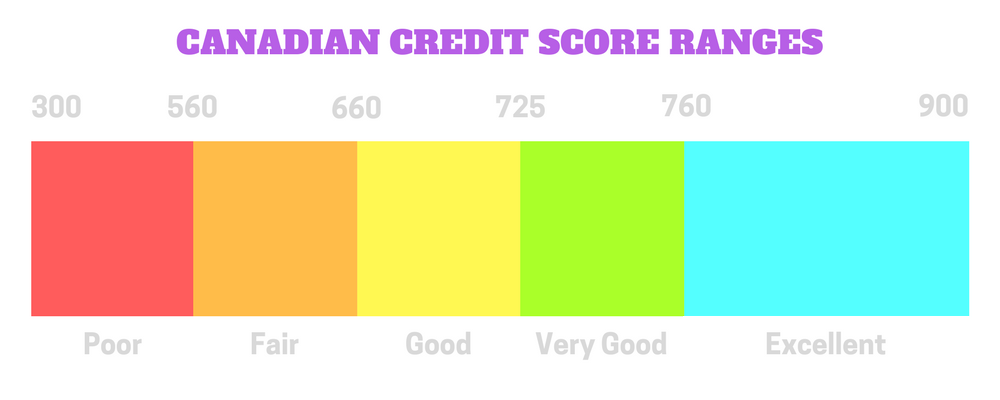

Get A Mortgage With A Bad Credit Score Wowa Ca

Pin By Jessica Hufford On Money Tax Checklist Tax Prep Checklist Tax Preparation

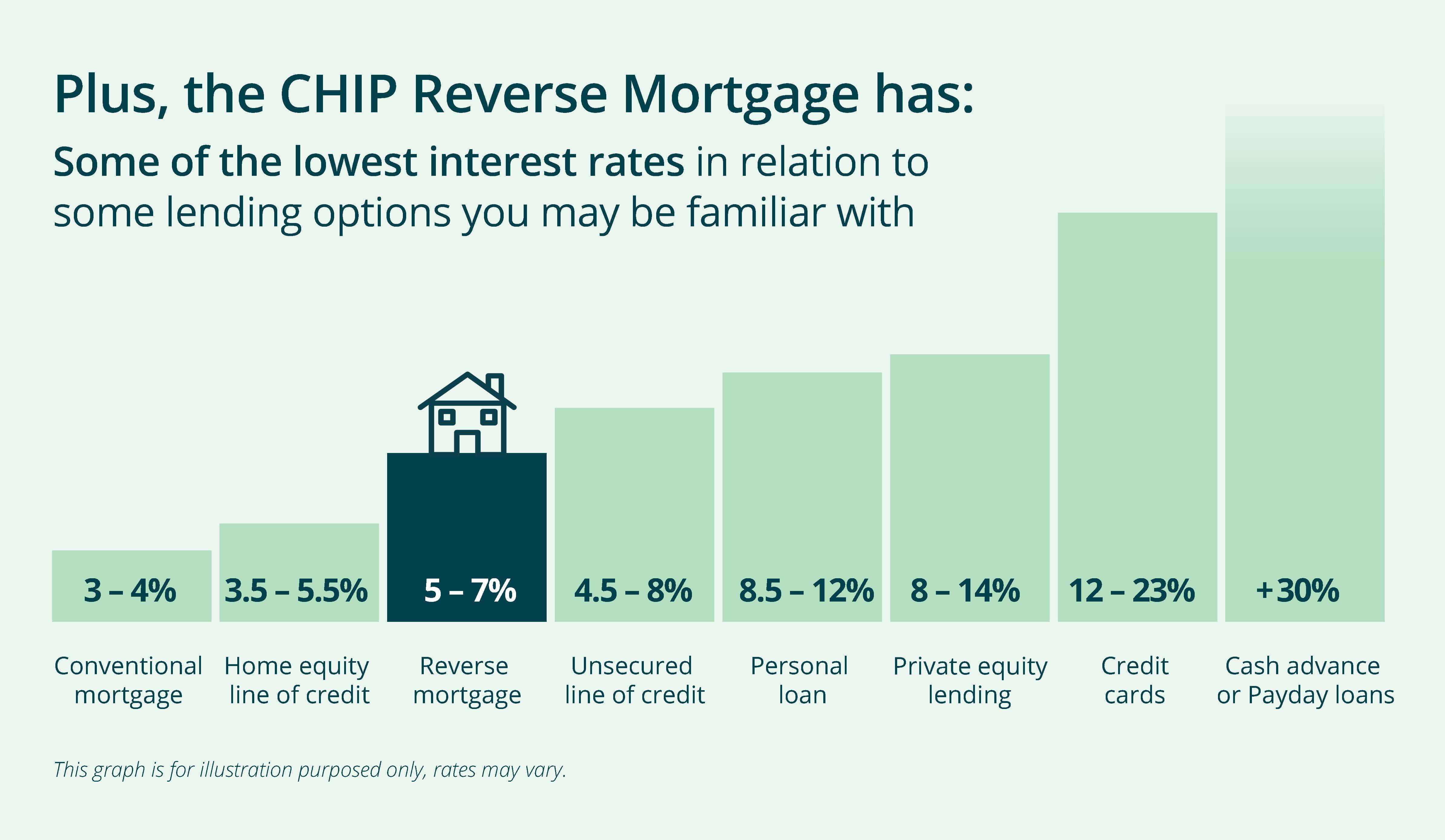

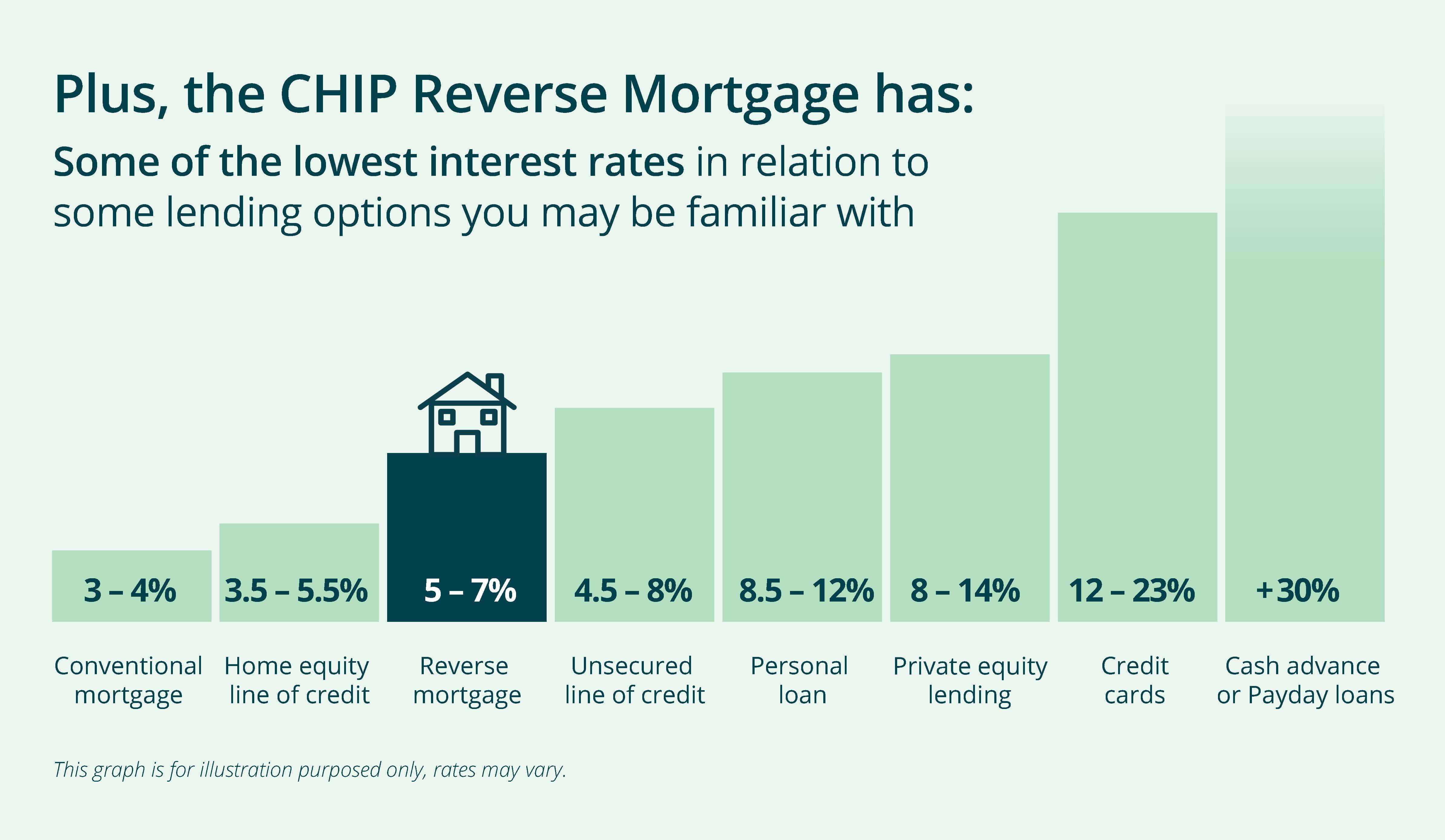

Downsides Of A Reverse Mortgage Understanding Pros And Cons

Marketing Home Coding Marketing Good Things

12 Things Canadians Don T Know About Second Mortgages Canadian Mortgages Inc

What Happens If You Miss A Mortgage Payment Loans Canada

Here S The Income You Need To Pass The Mortgage Stress Test Across Canada National Globalnews Ca

Mortgage Documents Checklist Loans Canada

So You Owe The Irs Bummer Here S How To Plan Better For Next Year Irs Taxes Property Tax Tax

Holidays In Selected Countries Notice The Uk Is Relatively Low On This List Although Some Typically Produ Holiday Pay Teaching Inspiration Best Pictures Ever

How To Make Your Canadian Mortgage Interest Tax Deductible

Infographic It S Your Money A Practical Guide The Super Savers Infographic Savers Finance Saving

Smith Manoeuvre Canada How To Make Your Mortgage Tax Deductible Mortgage Canada Youtube

How To Get Pre Approved For A Mortgage In Canada Approval Process Nesto Ca